The fight is on at Autodesk (NASDAQ: ADSK). On Wednesday Starboard sent a detailed letter to Autodesk shareholders, criticizing the company’s financial underperformance, governance missteps, and lack of accountability. With a $500 million stake in the company, Starboard is now gearing up for a proxy fight to push for board changes at Autodesk’s 2025 Annual Meeting and will be putting forward a minority slate of directors. Starboard believes that new leadership should achieve best-in-class profitability by cutting costs and improving operating efficiency with a target of 45% operating margins by FY2028.

Autodesk (ADSK) underperforming for shareholders amid governance issues

Key Issues Raised by Starboard

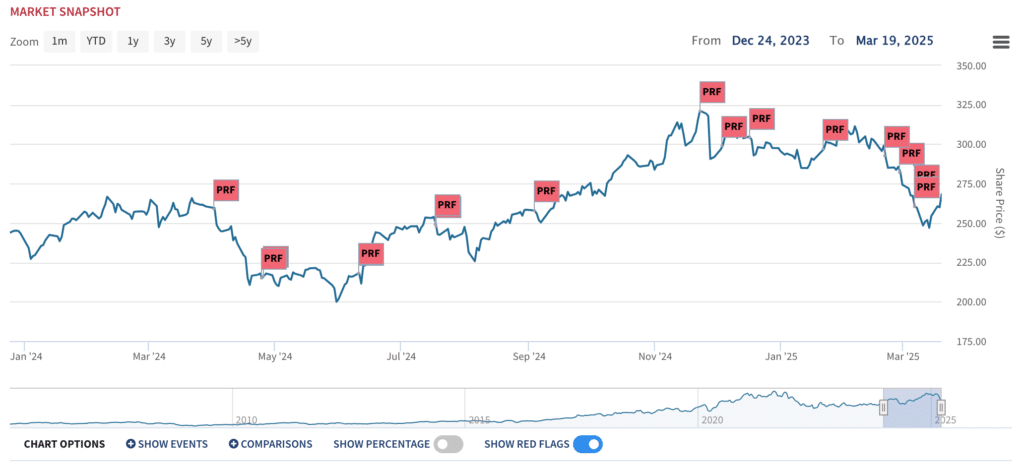

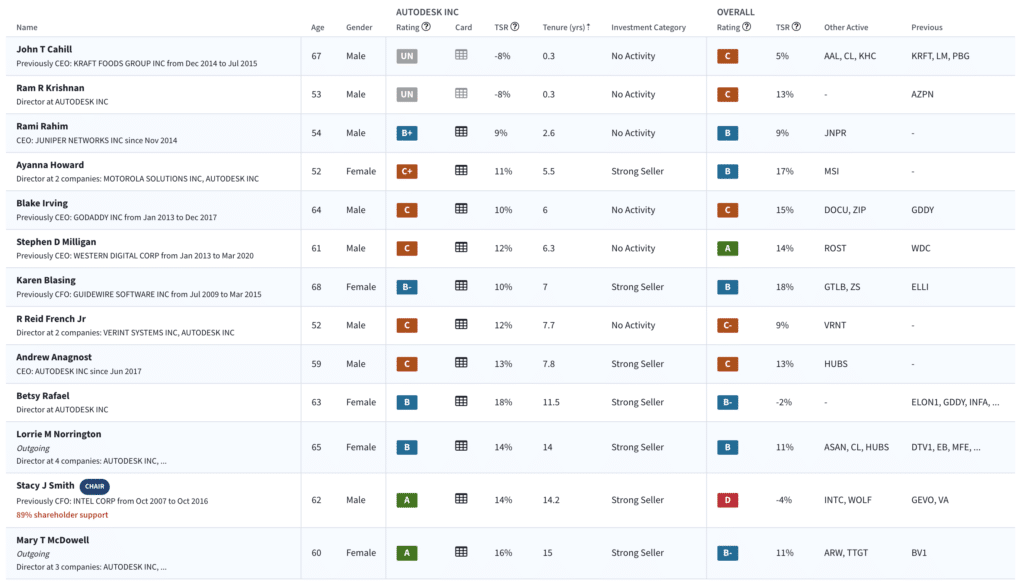

- Financial Underperformance: Despite being a leader in subscription-based design software, Autodesk has consistently missed financial targets and lags its peers in profitability. **Boardroom Alpha Note: Autodesk’s 1-year total shareholder return (TSR) is just 5% and is underperforming the S&P 500 across 1, 3, and 5-year horizons. CEO Andrew Anagnost’s almost 8-year tenure is rated as a C as Autodesk’s share price growth and revenue growth trails peers.

- Governance & Oversight Concerns: An Audit Committee investigation found that Autodesk misled shareholders about billing practices, yet the board imposed no meaningful consequences. **Boardroom Alpha Note: The board is currently overweighted to long-serving directors, but with the recent addition of John Cahill and Ram Krishnan and the upcoming exits of Mary McDowell and Lorrie Norrington the board will look meaningfully refreshed. However, shareholders will be concerned that Anagnost — an employee since 1997, ex-CFO, and CEO for almost 8 years — will have too much control.

- Operational Inefficiencies: Autodesk has industry-leading gross margins but significantly higher operating costs than comparable software firms. **Boardroom Alpha Note: CEO Andrew Anagnost has received compensation of almost $115M and sold almost $60M in stock over his tenure despite Autodesk’s mixed financial performance. Shareholders have started to take note and say-on-pay support slipped to 82% in 2024.

- Lack of Transparency: Starboard believes the company’s financial guidance is unclear, particularly concerning its recent 9% workforce reduction and how it affects future profitability.

Autodesk’s board is starting to refresh, but is it good enough and will CEO Andrew Anagnost be left with too much power?

The Audit Committee Investigation: A Costly Scandal

Autodesk’s governance concerns were amplified by an internal investigation into its accounting and billing practices, the results of which were released in May 2024. Key findings include:

- Autodesk relied on multiyear, upfront-billed contracts to meet free cash flow targets, incentivizing early renewals and payments.

- The company initially planned to transition enterprise customers to annual billing in fiscal 2023 but reversed course to help meet free cash flow goals.

- These actions led to inflated free cash flow in fiscal 2023, while discretionary spending decisions were influenced by non-GAAP financial targets.

- Autodesk voluntarily contacted the SEC, which has since launched an investigation, and the U.S. Attorney’s Office for the Northern District of California has also inquired into the matter.

- The company is facing shareholder lawsuits and has incurred significant legal and professional fees, with the potential for further penalties or regulatory action.

Starboard’s Recent Cooperation Agreements

Starboard has a history of engaging with underperforming companies and reaching agreements to drive change. Over the past two years, it has successfully negotiated cooperation agreements with multiple firms, including Fortrea Holdings, Healthcare Realty Trust, Alight Inc., and Bloomin’ Brands. These agreements have often resulted in board changes, committee restructuring, and governance enhancements.

For instance, in February 2025, Fortrea Holdings appointed a Starboard-backed director and agreed to potential further board additions. In December 2024, Healthcare Realty Trust underwent a major board overhaul, including the appointment of three independent directors backed by Starboard. Starboard has a long history of reaching agreements before it gets to a contested proxy and we’d expect similar here as they begin their full court press on Autodesk.

Olshan Frome Wolosky Behind the Scenes

Starboard is expected to rely on Olshan Frome Wolosky LLP, a law firm with a strong track record in shareholder activism. Olshan advised on both of Starboard’s recent agreements with Fortrea Holdings and Healthcare Realty Trust. More broadly, Olshan has played a role in many successful activist engagements recently including working with Engaged Capital (YETI, Evolent Health), Engine Capital (National Vision, LKQ, Orthofix), Legion Partners (Clear Channel Outdoor, Primo Water), and Elliott Investment Management (Southwest Airlines). The firm has played a key role in securing board seats, structuring cooperation agreements, and negotiating governance improvements for investors. Given its history of success, Olshan’s involvement further strengthen Starboard’s position in its campaign against Autodesk.

What’s Next?

We expect Starboard to win this battle before it comes to shareholders at the June shareholder meeting. While Autodesk has been proactively making moves to refresh the board, its track record both on performance and governance doesn’t make the grade. In addition, while the board is being refreshed by the company, investors will want to ensure they have a real hand on the wheel and that current CEO Andrew Anagnost doesn’t have too much power. The only way to do that will be to get their preferred people into the boardroom. And, if Starboard does win seats, we wouldn’t be surprised to see a new CEO at the helm before long.