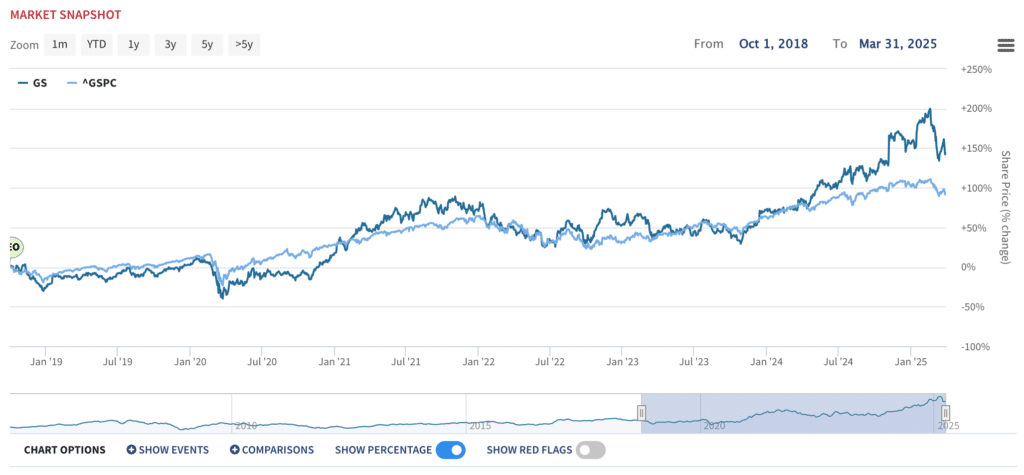

When a leadership team delivers outstanding results, both common sense and economic logic suggest they should be retained. Yet, despite Goldman Sachs’ (NYSE: GS) stock soaring over 140% under CEO David Solomon (with a 180% total shareholder return) and handily beating the S&P 500, proxy advisors Glass Lewis and Institutional Shareholder Services (ISS) oppose the firm’s decision to grant $80M in retention-based Restricted Stock Units (RSUs) to him and President John Waldron.

Their recommendations—like many that seem detached from actual shareholder interests—are not just misguided; they are irrational. Here’s why.

Why wouldn’t shareholders want to retain Solomon and Waldron?

Goldman Sachs’ Performance Speaks for Itself

Since David Solomon took over as CEO, Goldman Sachs has dramatically outperformed many of its peers and the broader market. Shareholder value has skyrocketed, proving that the current leadership team is executing at the highest level.

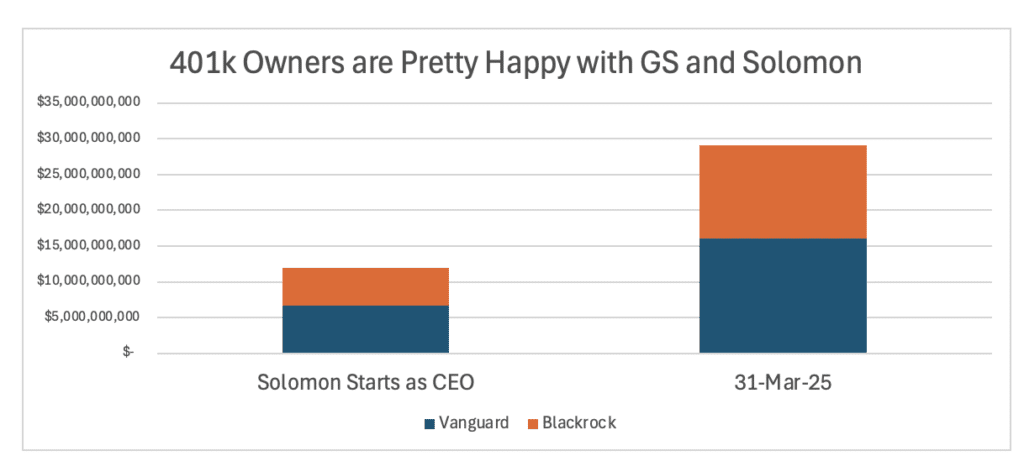

If you are one of the millions of Vanguard and Blackrock fund shareholders you’re likely quite happy that Solomon and Waldron are at the helm. According to their latest 13-F filings, Blackrock and Vanguard funds own approximately 53.2M shares of GS—meaning that everyday investors with 401(k)s, IRAs, and 529 college savings plans have benefited from over $17 billion in added shareholder value thanks to this leadership team. If executives who deliver these kinds of returns aren’t worth retaining, who is?

Raise your hand if you’re happy to have GS shares in your 401k

Yet, Glass Lewis and ISS continue to nitpick the details of these retention RSUs—ignoring the fundamental question that matters: Is Goldman Sachs a stronger, more valuable company today than it was before?

The answer is undeniably yes.

Retention RSUs: A Smart, Shareholder-Aligned Investment

The Goldman Sachs Board explicitly structured these RSUs to ensure leadership stability and continued execution on its strategic priorities. In the fiercely competitive financial sector, losing experienced leadership at a time of strong performance would be a major misstep.

Breaking Down the RSUs

- Retention-focused: Solomon and Waldron won’t see a dime unless they remain at the firm through 2030.

- Performance-linked: The $80M headline number is misleading–the real value is based on Goldman Sachs’ stock price in five years. At yesterday’s closing price of $546.28, the award is worth $71M (down from $612.99 on the grant date). If the stock doubles to $1,225, the award would be worth $160M—which would mean enormous gains for all shareholders.

- Minimal cost, massive return: The annual expense of these RSUs is approximately 0.2% of Goldman Sachs’ 2024 compensation and benefits expense–a tiny fraction of the billions created by this team.

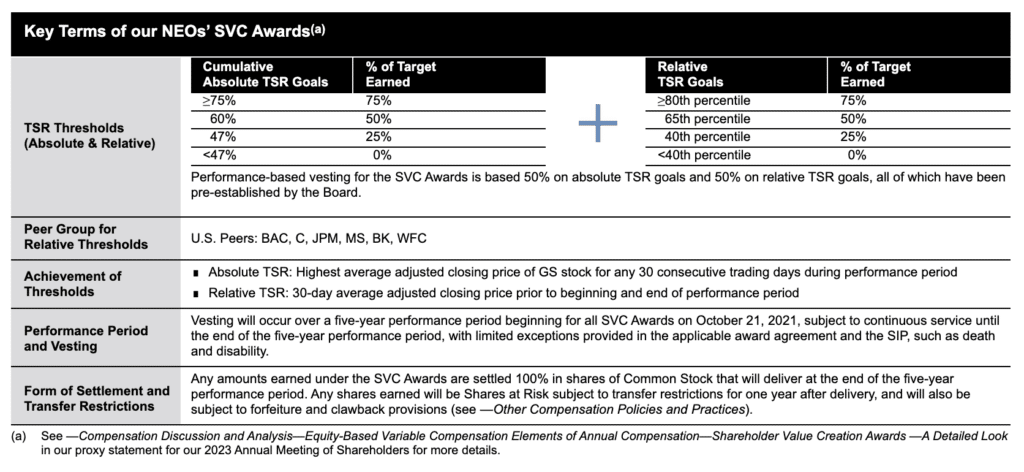

- Part of a broader plan: The retention RSUs are just one part of a broader executive compensation plan that contains performance-targets and similarly “well thought out” components such as clawbacks.

Goldman’s board already ties executive compensation to performance targets

Bottom Line: The RSUs Are a Smart, Low-Risk Investment

For shareholders, this structure is a win—it keeps top leadership in place and directly aligns their incentives with long-term stock performance.

ISS & Glass Lewis: Prioritizing Headlines Over Shareholders

ISS’s claim that the RSUs “lack rigorous, pre-set performance criteria” is misleading—these are retention incentives that are inherently performance-based. Their additional argument that “overlapping off-cycle awards” are a poor practice is irrelevant micromanagement, failing to recognize:

- Goldman Sachs’ financial success

- A competitive market for finance executives

- The Board’s strategic responsibility to retain top talent

This stance feels more like ISS and Glass Lewis chasing headlines—targeting executive compensation with a sensational $80M figure that, without proper context, sounds unreasonable to everyday investors.

This is no different from past instances where proxy advisors pushed arbitrary ESG targets that often harmed shareholder returns.

Conclusion: This is Smart, Long-Term Governance

Goldman Sachs investors should reject ISS and Glass Lewis’ flawed arguments. Their stance ignores financial realities, promotes unnecessary micromanagement, and ultimately risks shareholder value.

It’s also worth remembering:

- ISS and Glass Lewis are not shareholders—they are not impacted by Goldman Sachs’ stock price performance.

- Their arguments rely on subjective corporate governance preferences, not hard financial logic.

- These RSUs are not excessive giveaways—they are long-term incentives designed to lock in a leadership team that has delivered immense shareholder value.

- Will the stock price soar over the next five years? No one knows for certain. But what we do know is that these awards are reasonable, strategically sound, and well within the Board’s right to implement.

Now, imagine a different scenario: What if, in five years, Goldman’s stock price is cut in half?

That would mean the Board made the wrong leadership choices—and shareholders would be justified in voting them out based on the observable outcomes of their prior decisions.

That’s what real governance looks like. Goldman Sachs understands this, and proxy advisors should too.