Match Group (MTCH) has taken its first big moves in an attempt to fend off pressure from Anson Funds ahead of a likely contested proxy fight (we first wrote about the fight here). Yesterday Match Group announced two notable governance changes: the appointment of Darrell Cavens to the Board of Directors and an intention to seek shareholder approval to declassify the board. Both are steps in the right direction—but investors unhappy with the stock’s performance will certainly question whether they go far enough.

A New Director. New Ideas?

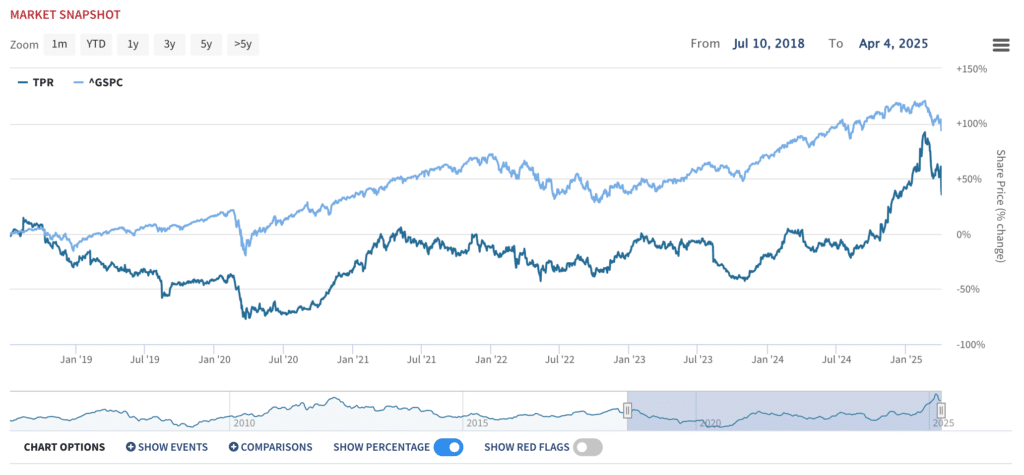

Darrell Cavens brings a strong background in e-commerce and product-focused leadership after being at Blue Nile, founding and bringing to IPO zulily, and serving on the board of Tapestry (TPR). However, investors will wonder about his track record as a public company executive (Boardroom Alpha rates his zulily tenure as a D and a C+ at Tapestry to date) and close ties to CEO Spencer Rascoff. After founding and bringing zulily to an impressive IPO, he saw its stock drop to less than a third of its value and exit for $2.4 billion to QVC. While IPO investors were hit hard, the exit to QVC resulted in nearly $1 billion for Cavens and co-founder Mark Vadon. His tenure at Tapestry (TPR) has been more mixed. He joined the TPR board in 2018 and saw the stock start a decline, eventually hitting its low during COVID, before rebounding to trade in a price range generally lower than when he joined. That is until it soared in late 2024 into 2025 and set an all-time high after its February earnings call (and subsequently getting hit alongside the rest of the market in the tariff spiral).

While Caven has been a director Tapestry’s (TPR) stock saw mixed performance until its recent surge

After an impressive IPO and early strength, ZU’s stock fizzled out.

Public company track record aside, the biggest questions around Cavens for investors may be around his close connection to CEO Spencer Rascoff—having served alongside him on the board of Zulily. Rascoff was also the chair of the compensation committee at zulily so was also responsible for setting Cavens’s compensation. This will raise questions about whether this appointment represents the kind of fresh, independent perspective investors have been calling for or a continuing reliance on a tight network that will result in similar thinking and an entrenchment of the status quo.

Declassification: Long Overdue but Welcome

The board’s decision to propose declassification is a welcome development and aligns with best practices in corporate governance. A declassified board allows shareholders to evaluate all directors annually and brings more accountability to the boardroom. However, it’s important to note that this shift comes only after direct pressure from investors and Anson Funds launching their proxy fight.

While this is certainly a reactive move by the Match Group board rather than a proactive one, the outcome—if approved—is nonetheless positive for shareholders.

Our Take: The Fight is Just Getting Started

Anson Funds, which has nominated three candidates—Fumbi Chima, Laura Lee, and Kelley Morrell–for election to the board, will certainly continue to advocate for more changes and continue their fight. For its part, Match’s board has rejected Anson’s nominees, arguing they do not offer meaningful additional skills aligned with the company’s strategy.

To us, Match’s recent announcements mark a shift—but perhaps not a transformation—and are certainly due more to Anson’s push than a real desire to make changes to the boardroom. So, our expectation is that unless Match takes more action, this fight will be left up to long suffering shareholders at the upcoming annual meeting.