Harley-Davidson (NYSE: HOG) is heading into its May 14th shareholder meeting under growing pressure from activist investor H Partners, which is calling for a boardroom shake-up and a new CEO amid ongoing performance and governance concerns. According to a Wall Street Journal report, the firm plans to run a withhold-the-vote campaign targeting three long-tenured board members and is urging Jochen Zeitz to step down immediately as CEO.

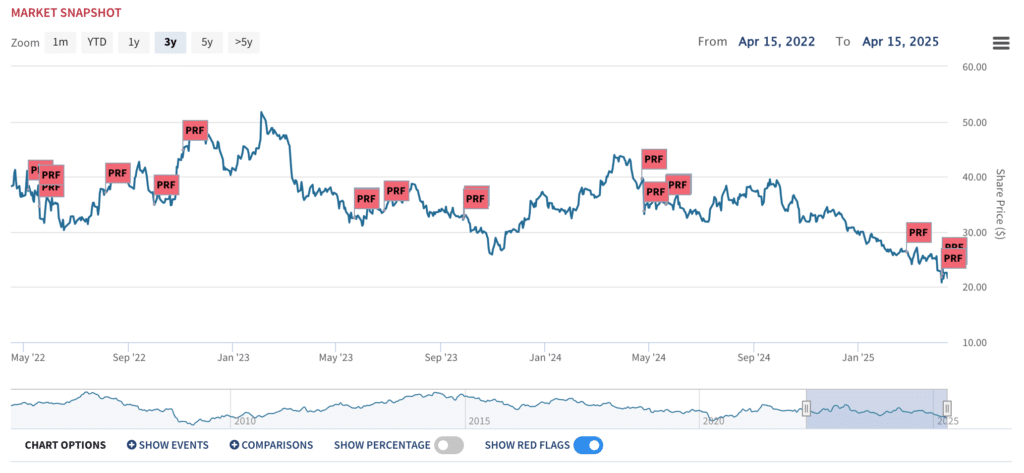

Harley-Davidson stock is suffering as the board and CEO fails to delivery

H Partners, which owns roughly 9% of Harley’s outstanding shares, has grown increasingly critical of the company’s leadership and strategic direction. Jared Dourdeville, the firm’s partner and former Harley board member, resigned earlier this month. In his April 5th resignation letter he cited may issues, but put particular focus on a “cultural depletion” stemming from the company’s remote work policy and executive turnover. Since then, the fight is becoming increasingly public, and toxic, with Dourdeville contesting HOG’s version of the story in his letter to the board on April 11.

Dourdeville was first added to the firm when Harley-Davidson and H Partners entered a cooperation agreement in February 2022. H Partners’ actions come right as the standstill agreement that once governed H Partners’ engagement expired on April 15, 2025, opening the door to more aggressive activism. While the firm is not nominating its own directors, the withhold campaign could trigger board resignations under Harley’s majority vote policy—setting the stage for a governance reset.

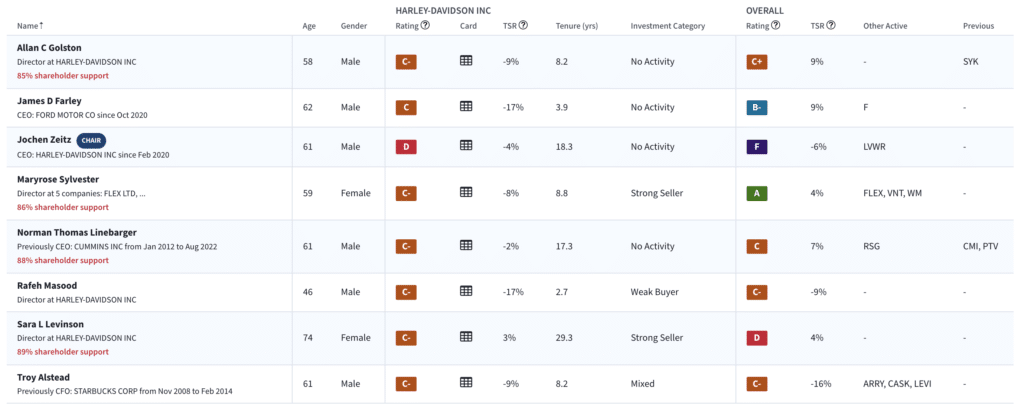

While Harley has announced it is already conducting a CEO search with an executive firm — in fact the directors have even voted upon candidates –, H Partners is pushing for greater urgency and a commitment to bring in an external leader. The campaign is targeting directors Zeitz (board tenure: 18+ years; director rating: D), Thomas Linebarger (17+ years, C-), and Sara Levinson (29+ years, C-)—all of whom face shareholder votes at the upcoming annual meeting.

HOG’s entrenched board hasn’t delivered

Harley-Davidson Underperformance and Shareholder Frustration

Boardroom Alpha data underscores the mounting concerns for HOG shareholders:

- Activist Vulnerability: 94 out of 100

- Total Shareholder Return (TSR) has consistently lagged:

- 1-year: -44% (vs. S&P 500’s +6%)

- 3-year: -16%

- 5-year: +5%, trailing the S&P’s +14%

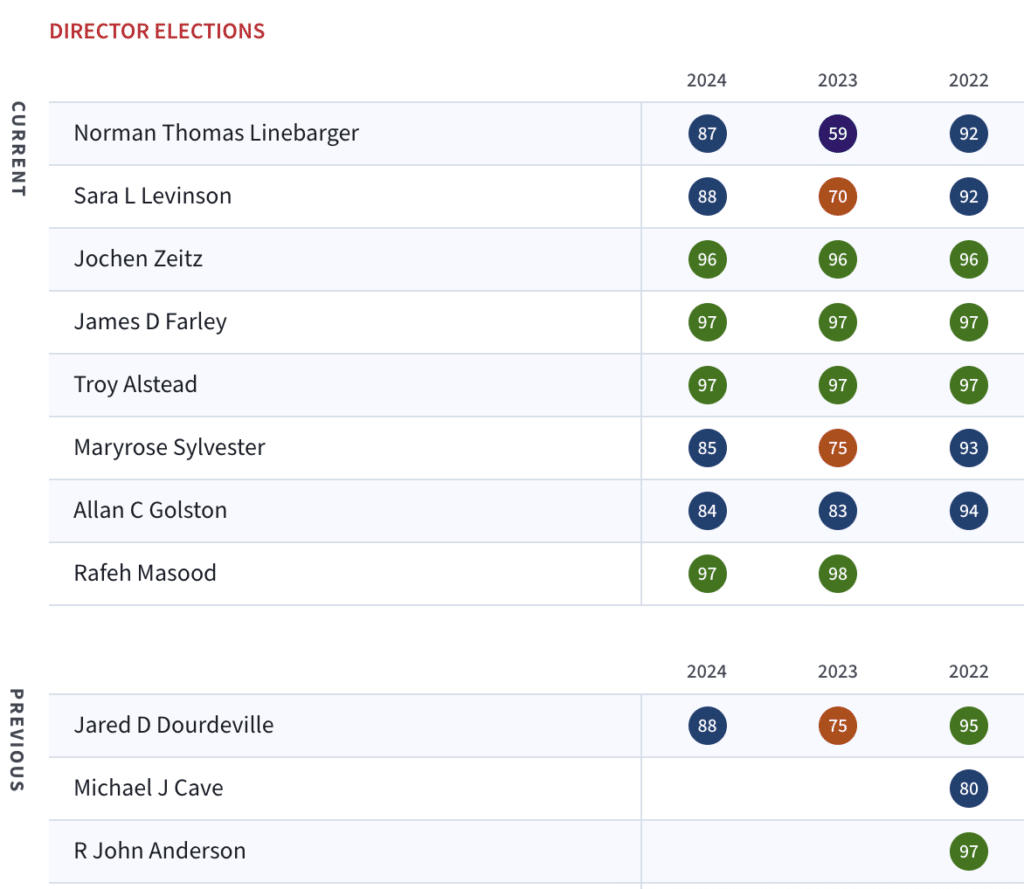

- Shareholders already showing lack of support for directors with 5 out of 9 directors receiving less than 90% support at the 2024 annual meeting.

- Say-on-Pay for 2024 passed with only 49% support, reflecting shareholder dissatisfaction with the company’s $9.1M CEO compensation amid poor stock performance. This follows on failed say-on-pay votes in 2023, 2022 after only modest support in 2021 and 2020.

- Board Ratings reflect consistent company underperformance:

- Overall Board: C-

- CEO Zeitz: a D director rating and -53% TSR since starting as a director in 2007.

- Director Sara Levinson: C-, also identified as a strong insider seller

- Zeitz is overcommitted and underperforming:

- Zeitz’s tenure as a director at Livewire (LWR) is also rated a D where is board chair and has seen the share price drop ~90% to just over $2

- Board red flags show governance issues:

- Categorized as an Entrenched Board

- Average director tenure is over 10 years (12.1 years)

- High CFO turnover

HOG directors already lack shareholder support

Our Take

Harley-Davidson (NYSE: HOG) is clearly underperforming and shareholders are losing out (Vanguard investors own ~10% of the firm). Based on track record, it is time for HOG to make drastic changes to its board and executive team. The only question is the extent to which shareholders — led by the Dourdeville and H Partners campaign — make that clear to the HOG board at the upcoming shareholder meeting.

For investors and governance professionals tracking this developing situation, Boardroom Alpha’s full HOG report offers detailed insights on board composition, shareholder support, executive performance, and insider activity. Visit Boardroom Alpha’s Harley-Davidson page for more.