In a move that shareholders will be hoping reshapes its future, YETI Holdings, Inc. (NYSE: YETI) has entered into a cooperation agreement with activist investor Engaged Capital. Signed on March 14, 2025, this agreement is a push by concerned YETI shareholders to right the ship after seeing the stock lose an annualized -17% over the past three years. The board, with a C- average Boardroom Alpha rating, and management seem stuck and in need of new ideas.

YETI’s stock and board are both underperforming

Glenn Welling and the Engaged Capital team has been active over the past several years. Just this past month they entered a cooperation agreement with Evolent Health (EVH). Several of their high profile engagements include Shake Shack (SHAK) which was up 46% a year out from their agreement and Quotient Technology which led to an acquisition by Neptune Retail Solutions. Engaged Capital is also currently at the start of a proxy fight with Portillo’s Inc (PTLO) where it hopes to get both Charlie Morrison and Nicole Portwood onto the board of the underperforming restaurant chain. Morrison is the former CEO of Wingstop and Portwood is the former CEO of Tito’s Handmade Vodka.

Revitalizing YETI’s Board

As part of the agreement, Arne Arens and J. Magnus Welander will join YETI’s Board of Directors, bringing their deep expertise in global consumer brands and outdoor lifestyle companies. This expansion increases the Board to 10 members, with nine independent directors.

- Arne Arens: Former CEO of Boardriders, Inc., with leadership roles at The North Face and Nike.

- J. Magnus Welander: Former CEO of Thule Group AB, with executive experience at Envirotainer and Tetra Pak.

Beyond the board expansion, Engaged Capital has agreed to standstill restrictions, limiting its ability to increase ownership beyond 9.9%, nominate directors, or engage in proxy battles. The agreement also includes voting commitments, ensuring alignment between Engaged Capital and YETI’s Board.

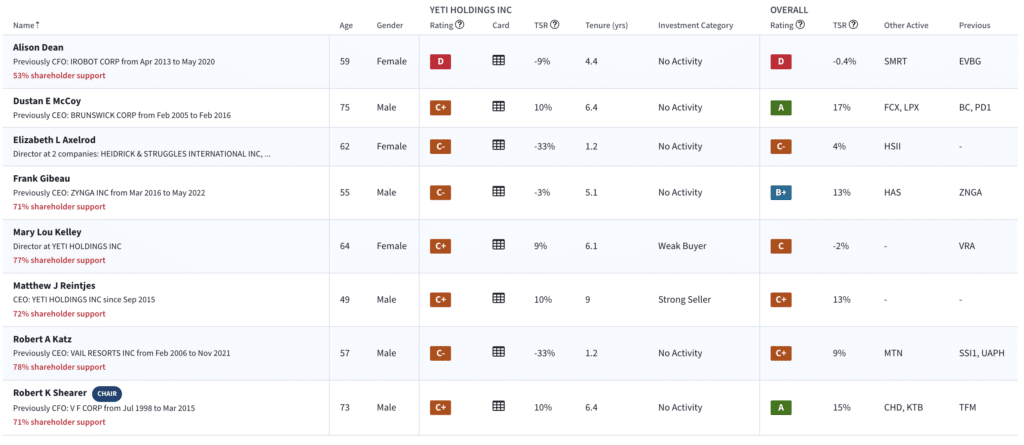

YETI’s board prior to the Engaged Capital cooperation agreement

What Message is the Board Hearing?

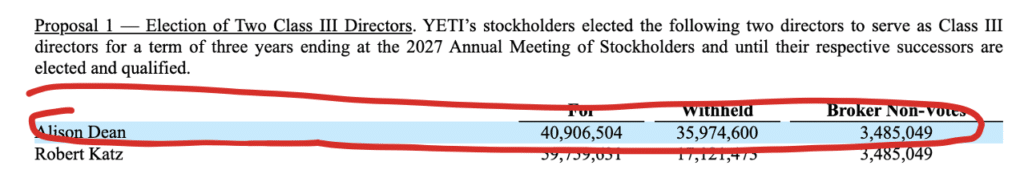

Despite what we’d call disastrous shareholder support at recent shareholder meetings for directors — Alison Dean barely received over 50% support yet remains on the board — the company hasn’t yet been compelled to make a change. It remains a mystery to us how the owners of the company could be sending such clear messages to the the board — that works for the shareholders — as this vote and yet the board to not see a need to change.

Shareholders are sending a clear signal to the board

YETI Insiders Aren’t Buying the Dip

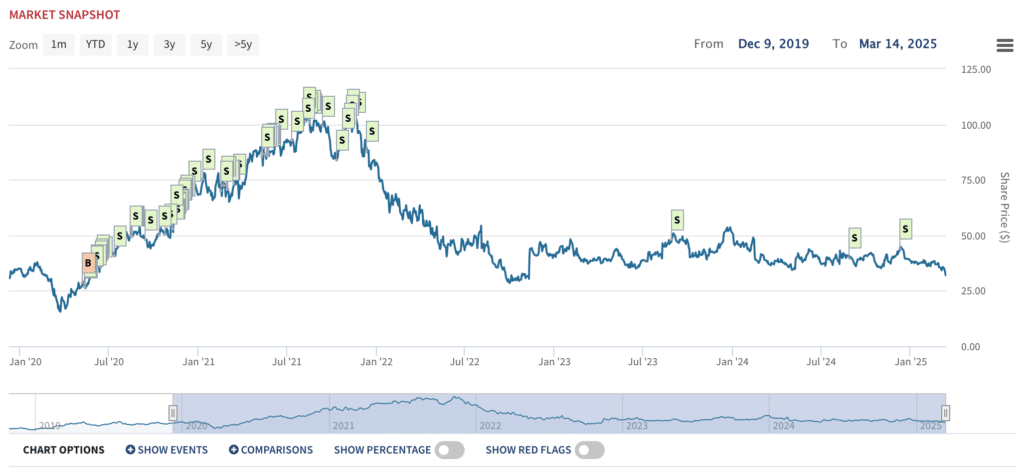

While YETI is considered a leading brand in premium outdoor products, shareholders haven’t seen that translated to stock performance recently. Despite that, insiders continue to receive sizable compensation. Over the past year the stock is down -13%, but CEO Matthew Reintjes earned over $10M in 2023 with $1M in salary and almost $8M in equity awards and has sold over $44.7M dollars in YETI stock over his 9.5 year tenure.

At Boardroom Alpha, we always like to take a look at which, if any, insiders are using their own money to bet on their company rather than just taking a check. At YETI, it would be safe to assume shareholders won’t think the current board has much belief in their ability to turn the ship around given their zeal in selling at the peak and total lack of buying since it started its decline. To anyone outside the boardroom, the chart below will look like insiders capitalizing on a once-in-a-lifetime stock high than it does one of real belief and commitment in the long-term success of YETI.

YETI insiders capitalized on a once-in-a-lifetime selling opportunity. And, they aren’t buying the dip.

Final Thoughts: What’s Next for YETI?

Shareholders will be glad to see the board getting fresh, independent thinking with relevant experience in Arens and Welander. They will also be glad to see a proactive, forceful shareholder pushing for changes in Engaged Capital.

From a governance perspective, we’d like to see the board shrink down — there is no reason for this company to be paying for 10 board members — into a slimmer, fresher version. We’d also like to see the board declassify to make it easier for shareholders to assert themselves in the future in the event that the trajectory doesn’t change. And, we’ll also be surprised if we don’t see a new CEO sooner rather than later given Boardroom Alpha’s elevated CEO Hot Seat Score (a measure of how likely a CEO is to be dismissed) and the belief that as the board is re-energized and re-constituted, it will likely look to do the same to the executive office. Finally, we expect shareholders to wake up to the disparate outcomes for themselves relative to insiders and take more issue with CEO and executive pay going forward.