Corporate leadership is under more scrutiny than ever, and Boardroom Alpha’s new CEO Hot Seat Score is delivering data-driven insights into which CEOs are thriving and which are at risk of being pushed out. Boardroom Alpha’s model is built on objective financial, governance, and CEO characteristics, utilizing machine learning, and real-time data to provide clear signals of leadership stability—or potential disruption.

Subscribers: See the full listing of CEOs on the Hot Seat here.

What is the CEO Hot Seat Score?

The CEO Hot Seat Score is a quantitative assessment that enables stakeholders to evaluate whether US public company CEOs are thriving and driving outperformance for their companies or if they are at risk of dismissal based on poor performance. The CEO Hot Seat Score is based on a historical data set of CEO turnover and uses three sets of factors — CEO attributes, company performance metrics, and governance factors — to predict the likelihood of the CEO being dismissed in the next 6 months. The result? A clear, unbiased signal of CEO stability—or potential disruption.

This data-driven approach removes bias and offers a transparent, market-driven measure of CEO stability. Investors, insurers, advisors, and companies themselves are adopting the score to anticipate leadership changes and mitigate governance risks.

CEOs in the Hot Seat

The following table highlights some of the CEOs with elevated Hot Seat Scores across companies with more than $5B in market capitalization:

| Company Name | Ticker | CEO (Linked) | Tenure (Years) | CEO Grade | Board Grade | Hot Seat Score | Hot Seat Score 6-Month Change |

Activist Vulnerability |

|---|---|---|---|---|---|---|---|---|

| Rivian Automotive Inc. | RIVN | Robert J. Scaringe | 3.4 | D | D | 80 | +16 | 98 |

| Restaurant Brands International Inc. | QSR | Joshua Kobza | 2.1 | C- | C+ | 80 | +6 | 78 |

| Rocket Companies Inc. | RKT | Varun Krishna | 1.6 | B- | C- | 73 | +15 | 72 |

| Cognizant Technology Solutions Corp. | CTSH | Ravi Kumar Singisetti | 2.2 | A- | C | 67 | -11 | 72 |

| Snap Inc. | SNAP | Evan Spiegel | 12.9 | C- | C- | 78 | -2 | 75 |

Spotlight: CEOs Facing Performance Pressure

Robert J. Scaringe – Rivian Automotive (RIVN)

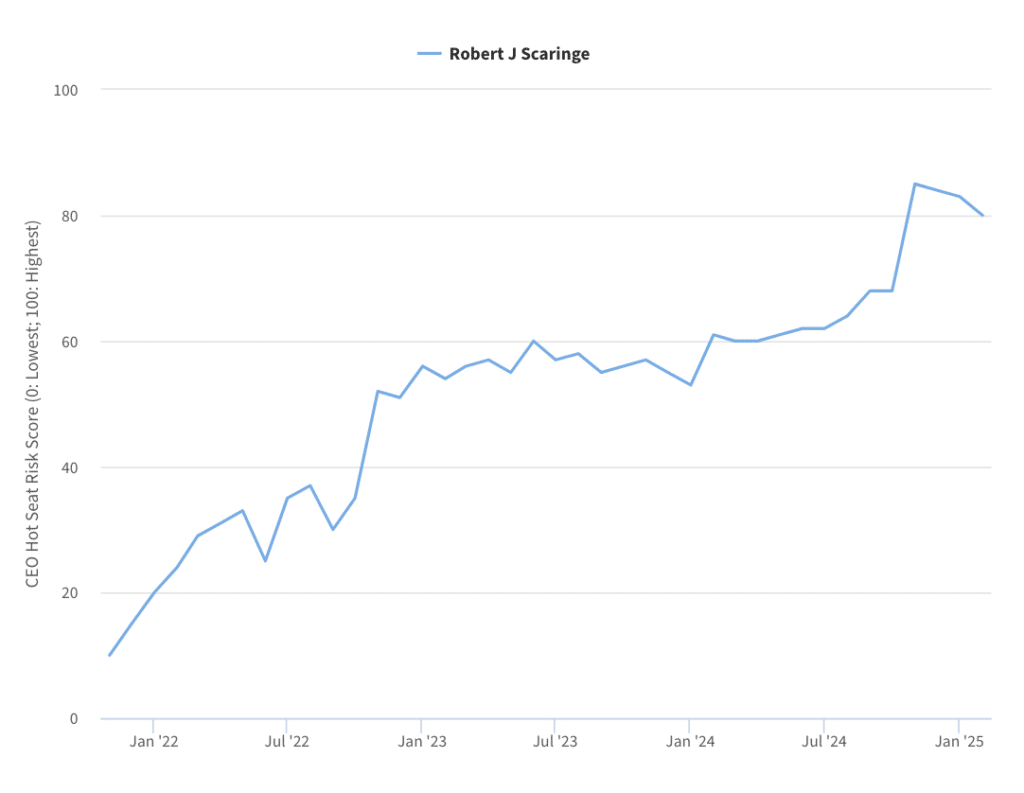

Scaringe built Rivian from the ground up, but the company is struggling since its IPO in 2021. Its stock has plummeted, supply chain challenges persist, and revenue growth remains weak as competition in the EV space intensifies. Investors have grown restless, and class action lawsuits have started to surface over missed projections and production delays. Rivian’s CEO Hot Seat Score has jumped by 16 points in the last six months, indicating continued underperformance and growing risk.

Scaringe’s risk of dismissal continues to rise as performance lags.

Scaringe’s tenure as CEO of Rivian, while it’s been publicly traded, is a D which is driven by Rivian’s underperformance relative to peers. The board also looks in need of an overhaul with a D rating and limited outside public company experience. Those that do have outside experience like Karen Boone and Pamela Thomas-Graham have similarly poor track records at companies like Peloton (PTON), Bumble (BMBL) and Sonos (SONO). Given the challenges, shareholders will want to know whether the board has the ability to change Rivian’s trajectory. Compounding their challenge could be the difficulty of removing a founder from the CEO position. But, we’ve seen it happen before and two of the board have done it before — Boon and Thomas-Graham were both on the board of Peloton (PTON) when co-founder John Foley was pushed out.

Rivian’s board and executives are struggling to turn the stock around.

Joshua Kobza – Restaurant Brands (QSR)

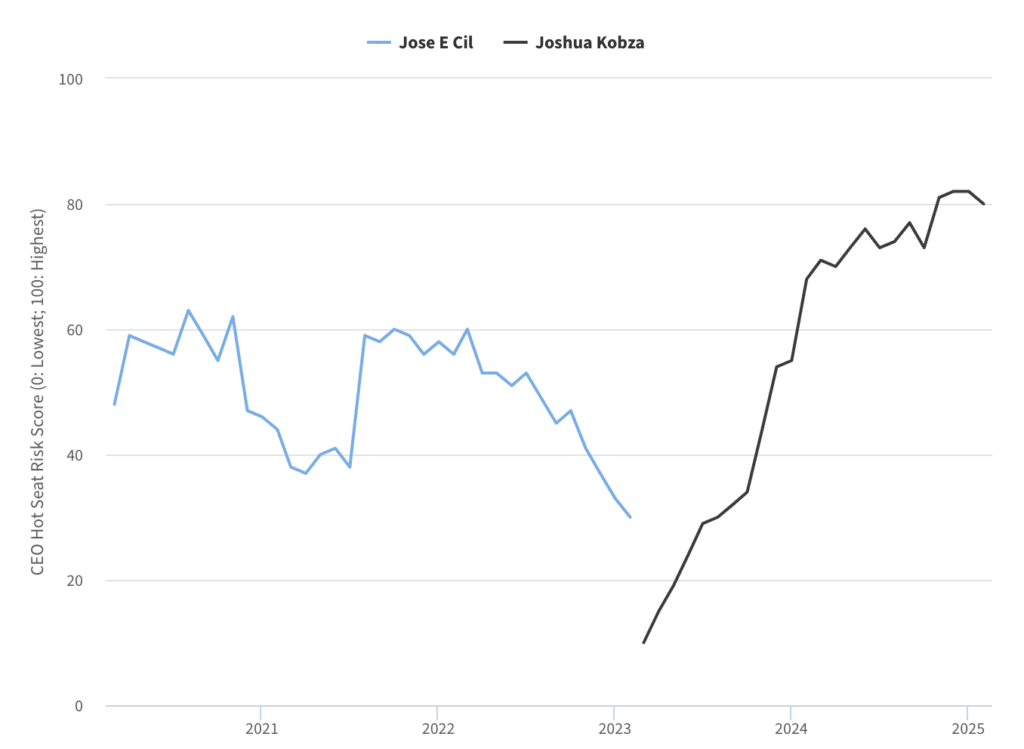

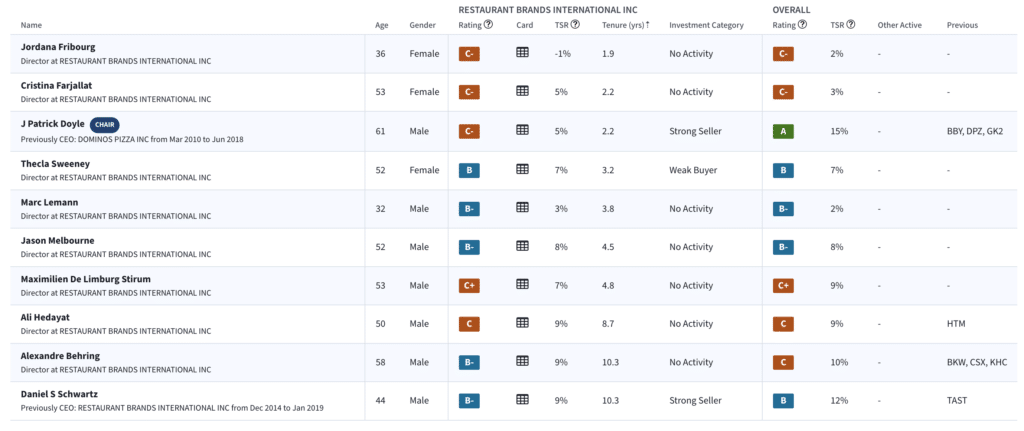

Kobza is just over 2 years into his tenure as CEO, but given a largely stalled out stock price with big up and down swings, he’s already under pressure. Burger King’s turnaround efforts have stalled, and franchisee tensions have escalated amid concerns over rising costs and weak sales growth. Ex-CEO Jose Cil had made it through COVID, but was unable to re-ignite the stock going forward. While his CEO Hot Seat Score dropped at the end of his tenure, it was elevated in the months prior to his departure in early 2023.

Ex-CEO Jose Cil made it through COVID, but handed off a struggling QSR to Kobza

Kobza’s C- CEO rating is another data point showing QSR’s lackluster performance over his tenure. His board has a slightly better C+ grade, but with little outside public company track experience to give investors confidence in the board’s ability to turn things around, both the executives and board will be under pressure. With 6-point increase in his Hot Seat Score over the past six months, the risk of board or shareholder intervention — especially given QSR’s Activist Risk Vulnerability score is now hovering around an elevated 80 — is climbing. And, with Bill Ackman’s Pershing Square as one of QSR’s top holders, you know that Kobza and the board will only have so much time.

Will QSR board with limited public company experience be ready to take action?

Varun Krishna – Rocket Companies (RKT)

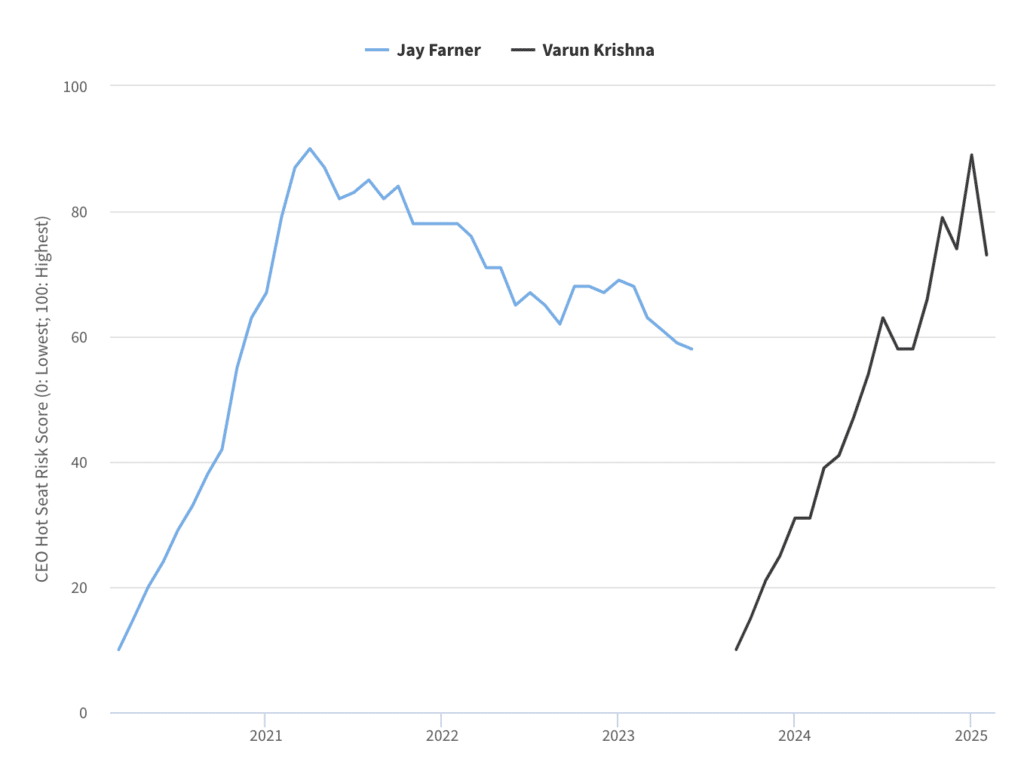

Previous Rocket Companies (RKT) CEO Jay Farner left with a D rating and a -26% annualized shareholder return and with new CEO Varun Krishna immediately under pressure. After an initial surge in the stock during the first year of his tenure to over $20, Rocket’s stock dropped near $10 in January of 2025. While the stock has been slowly coming back up, Boardroom Alpha’s Activist Vulnerability and CEO Hot Seat Risk scores remain elevated. Both jumped as the stock suffered it’s significant drop with the latter no standing 15 points higher than it did six months ago.

Will the RedFin acquisition sink or save Krishna?

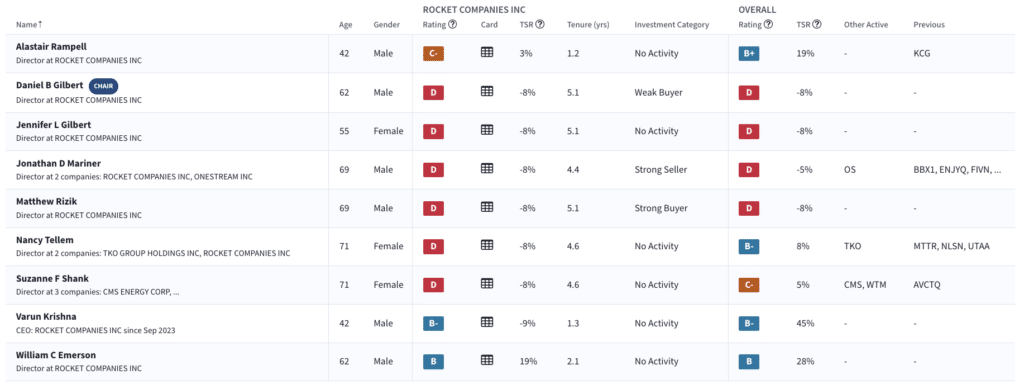

Rocket Company’s board is controlled by Dan Gilbert, Rocket Company’s founder, who also has maintains over 90% ownership of outstanding RKT’s shares. Also, in an unusual situation for public company boards, his wife Jennifer Gilbert. CEO Krishna and the board just announced an a $1.75B acquisition of real estate listing platform RedFin on March 10th. Shareholders were skeptical with RKT dropping on the news. Krishna’s future will almost certainly depend on whether or not the RedFin acquisition is a success.

Founder Dan Gilbert controls the board.

Ravi Kumar Singisetti – Cognizant (CTSH)

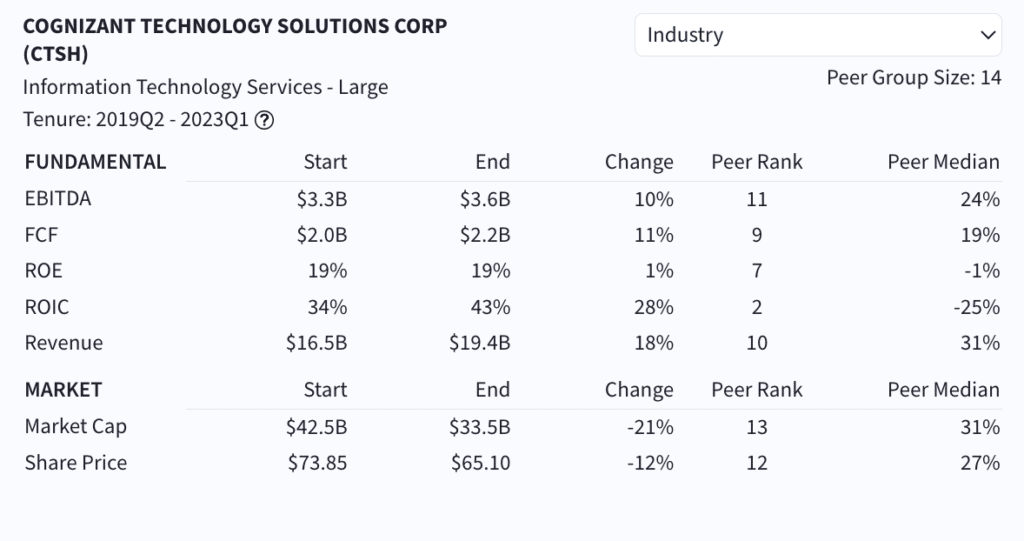

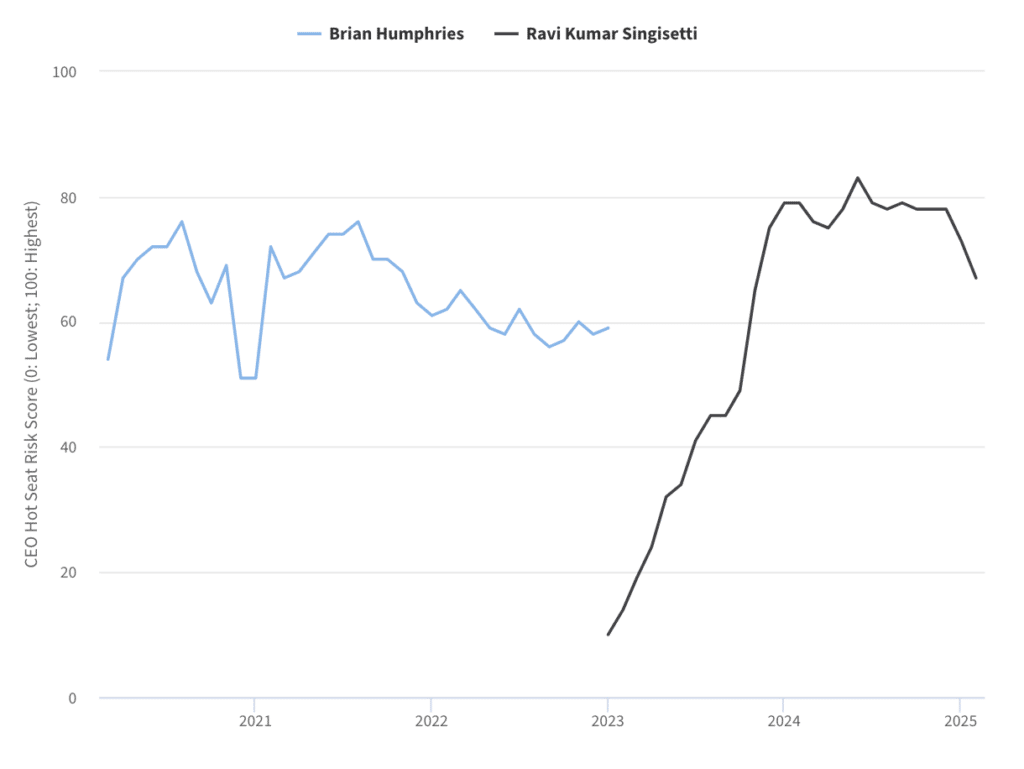

Unlike the others on this list, Singisetti appears to be stabilizing Cognizant after previous CEO Brian Humphries saw Cognizant perform amongst the worst of their peers on most measures. Singisetti took the reins from Humphries in at the start of 2023 and has so far delivered a total shareholder return over 23%.

Previous CEO Brian Humphries’s tenure saw Cognizant on the decline

Can Singisetti get CTSH back on track?

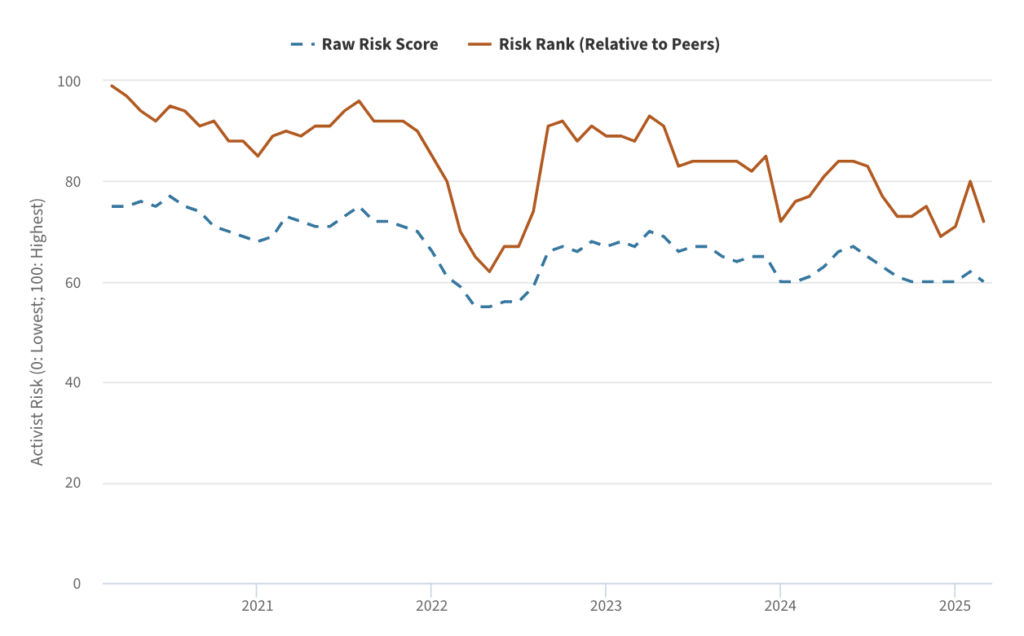

While Singisetti’s Hot Seat Score is elevated, we expect to see that continue to decline — already dropping 11 points from six months prior — as long as Cognizant’s recover remains apace. Shareholders seem pleased so far given their overwhelming support for Singisetti at the last shareholder meeting.

A continued decline in CTSH’s Activist Vulnerability score will also signal Singisetti has the company back on track

Data-Driven Decisions in a High-Stakes Environment

The CEO Hot Seat Score isn’t just a warning signal—it’s a tool that enables investors, boards, and stakeholders to make better, data-driven decisions in an era where leadership missteps can erode billions in shareholder value overnight. Whether it’s Robert Scaringe struggling to steer Rivian through financial and operational turbulence, Joshua Kobza facing mounting franchisee unrest at Restaurant Brands, or Evan Spiegel trying to revitalize Snap’s fading relevance, the challenges facing these CEOs underscore why real-time, comprehensive analysis of leadership performance and governance is essential.

Without clear, objective measures, companies risk being blindsided by underperforming executives, misaligned governance, and activist interventions. Boardroom Alpha’s performance-focused, analytic driven approach provides the transparency needed to assess whether a CEO like Varun Krishna at Rocket Companies is on borrowed time, or if a leader like Ravi Kumar Singisetti at Cognizant is successfully stabilizing the ship.