Know Who Drives Return

Performance & Governance analytics for every US public company officer, director, and the companies they run.

Management Matters

Knowing the quality of the executive team and board is essential. Only Boardroom Alpha is trusted by top activists, pension funds, legal firms, underwriters, and the companies themselves to deliver un-biased, effective analysis of the team and how they are governing.

The Boardroom Alpha Rating

Returns

Financials

Establishing the right financials to drive long-term value and innovation.

Events

including capital allocation decisions.

Investment

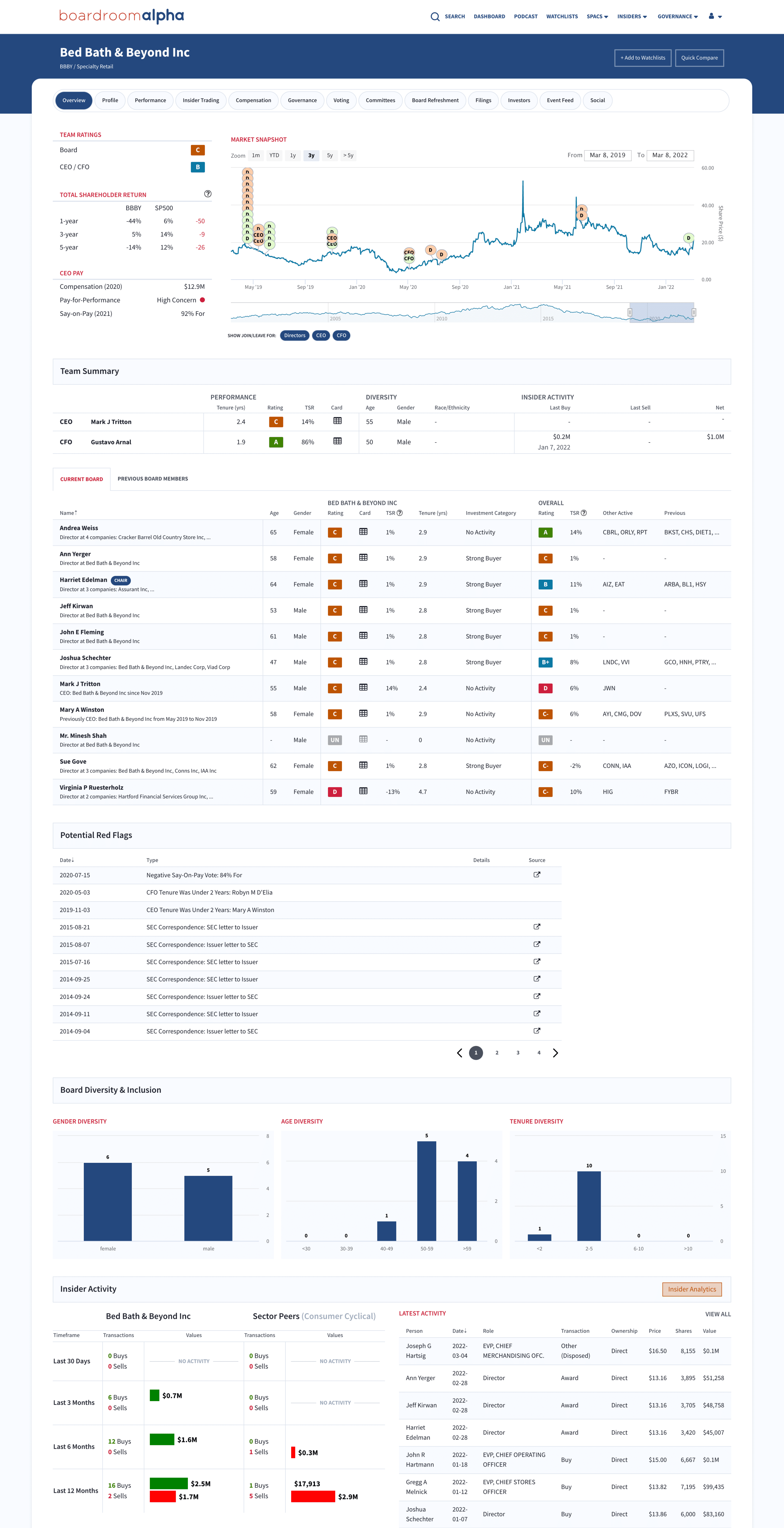

Comprehensive Company and Team Profiles

Identify potential risks with independent, quantitatively driven assessments for every US publicly traded company.

Assess across all aspects including company performance, governance practices, shareholder voting / engagement, CEO/CFO/Director track records, and more.

Potential red flags help identify key risks that may need further investigation.

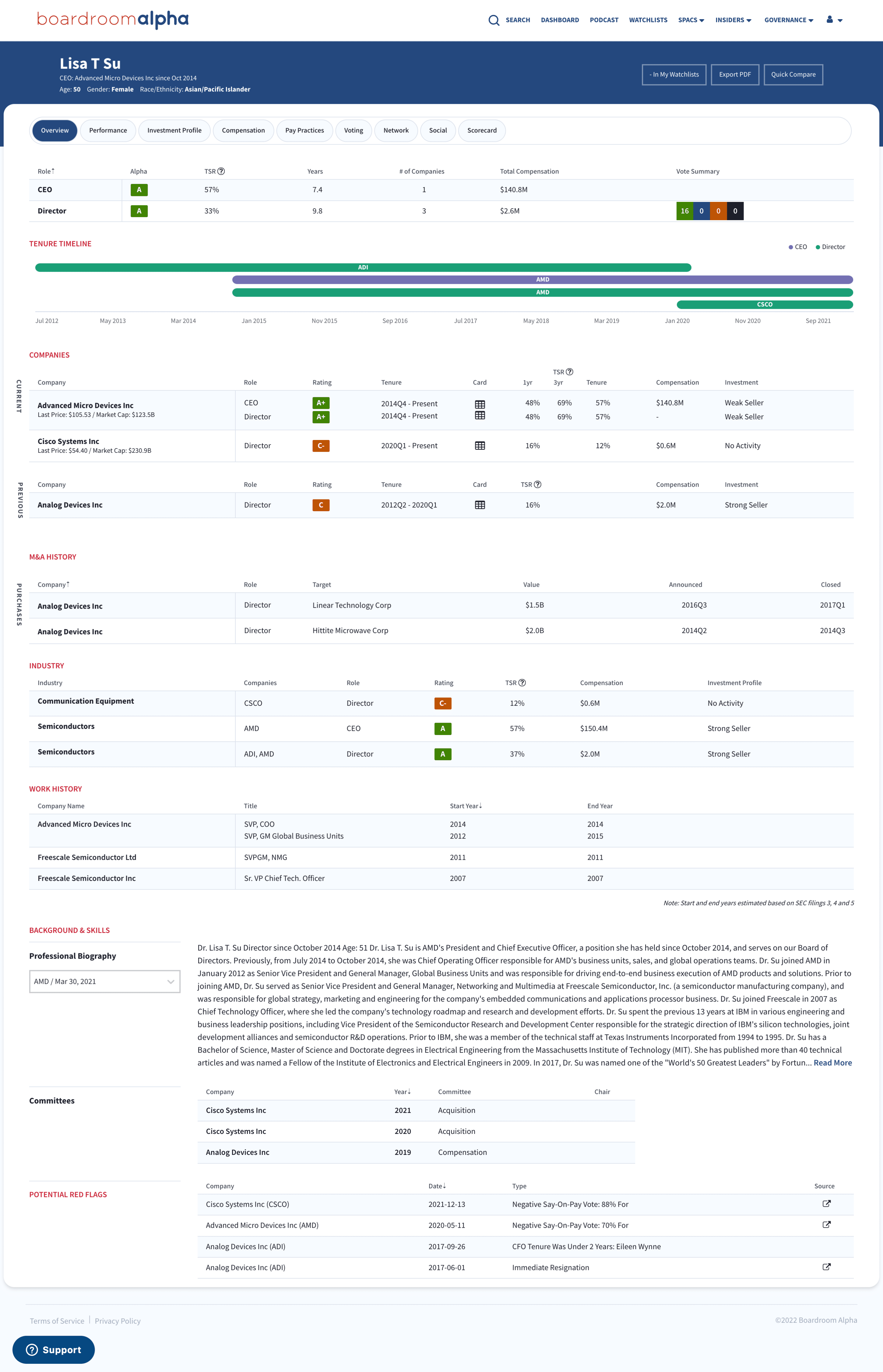

Know the CEO, CFO & Directors

Boardroom Alpha provides comprehensive scorecards on over 200,000 directors, CEOs, and CFOs at US public companies and all SPACs.

Every scorecard provides detail on their background, biography, diversity, and in-depth data and analytics on their track record as a public company executive and details on their unique attributes.

Corporate Governance Red Flags for Companies and Executives

Monitor for the potential governance red flags that investors, proxy advisors, and others are watching for.

Governance risk factor coverage includes: terminations, immediate resignations, high CEO/CFO turnover, investigations from SEC and other groups, class action activity, accounting firm dismissals, SEC filing and technical violations, and more.

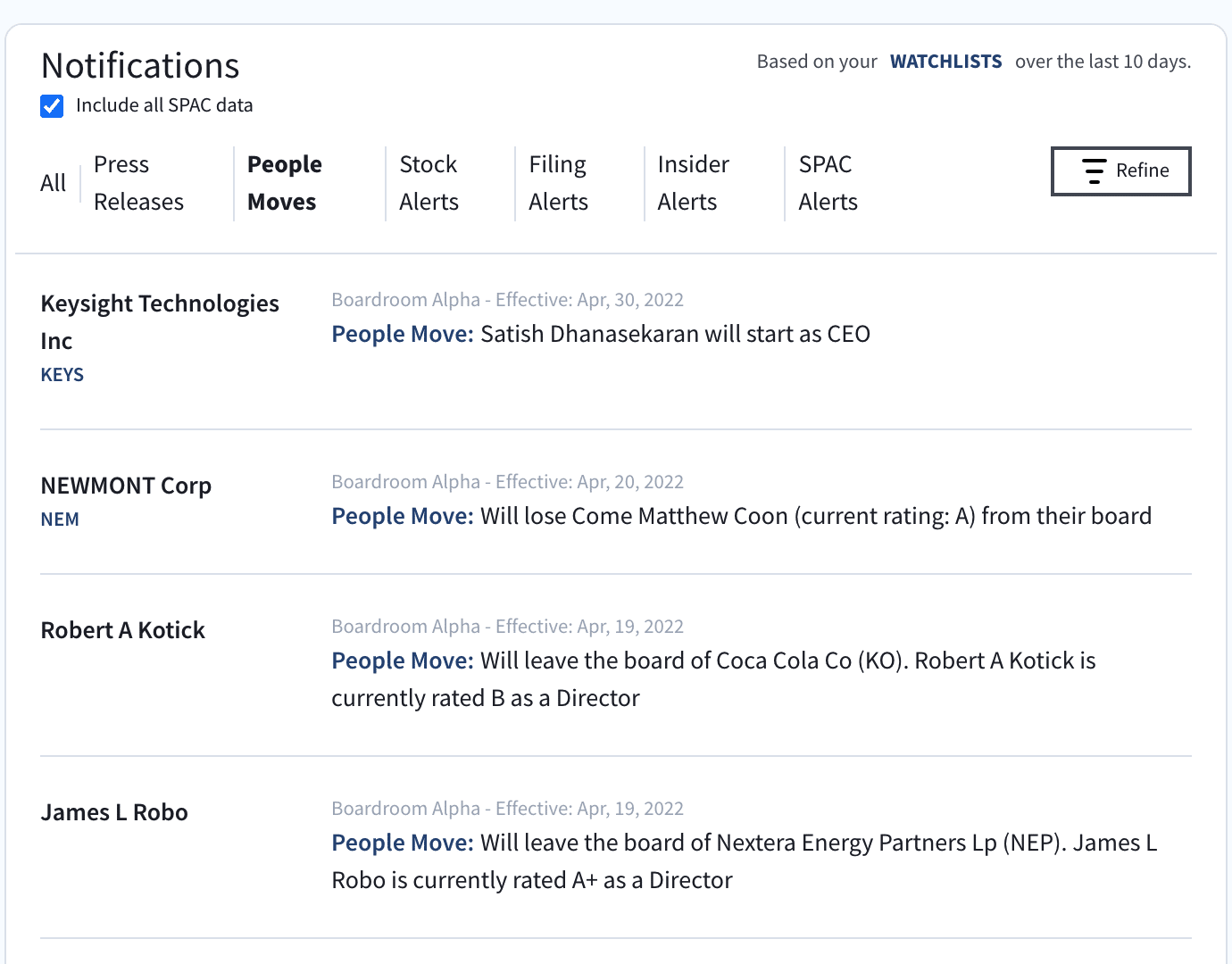

Monitor CEO, CFO, and Director Moves

Monitor CEO, CFO, and director moves as they happen. Understand on new executives will impact the company and how departures could create new risks.

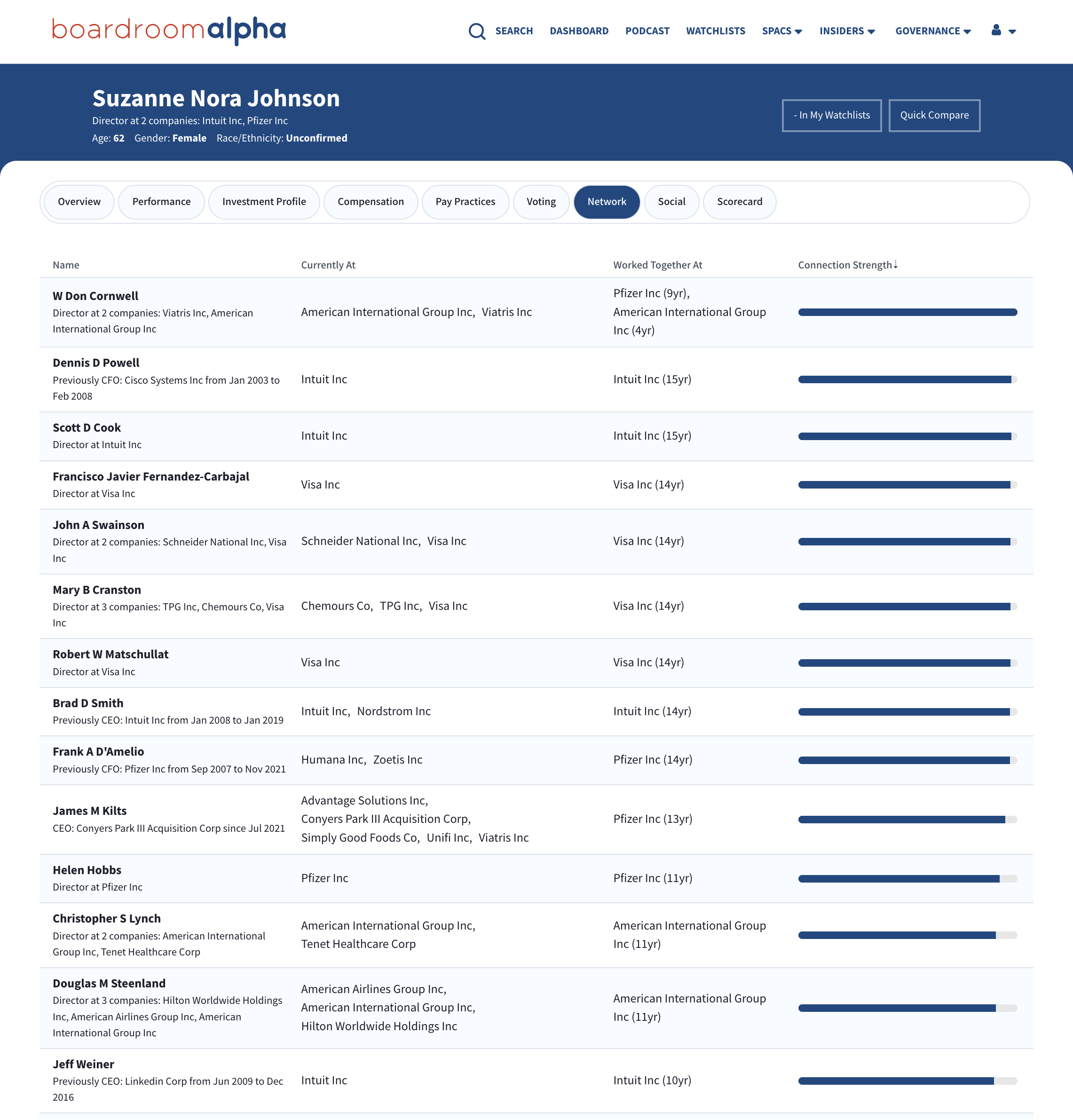

Identify Executive Relationships & Board Interlocks

For every executive see how they are connected across people and companies — including assessments for the strength of each relationship.

Quickly identify potential risks from board interlocks across companies for every officer and director.

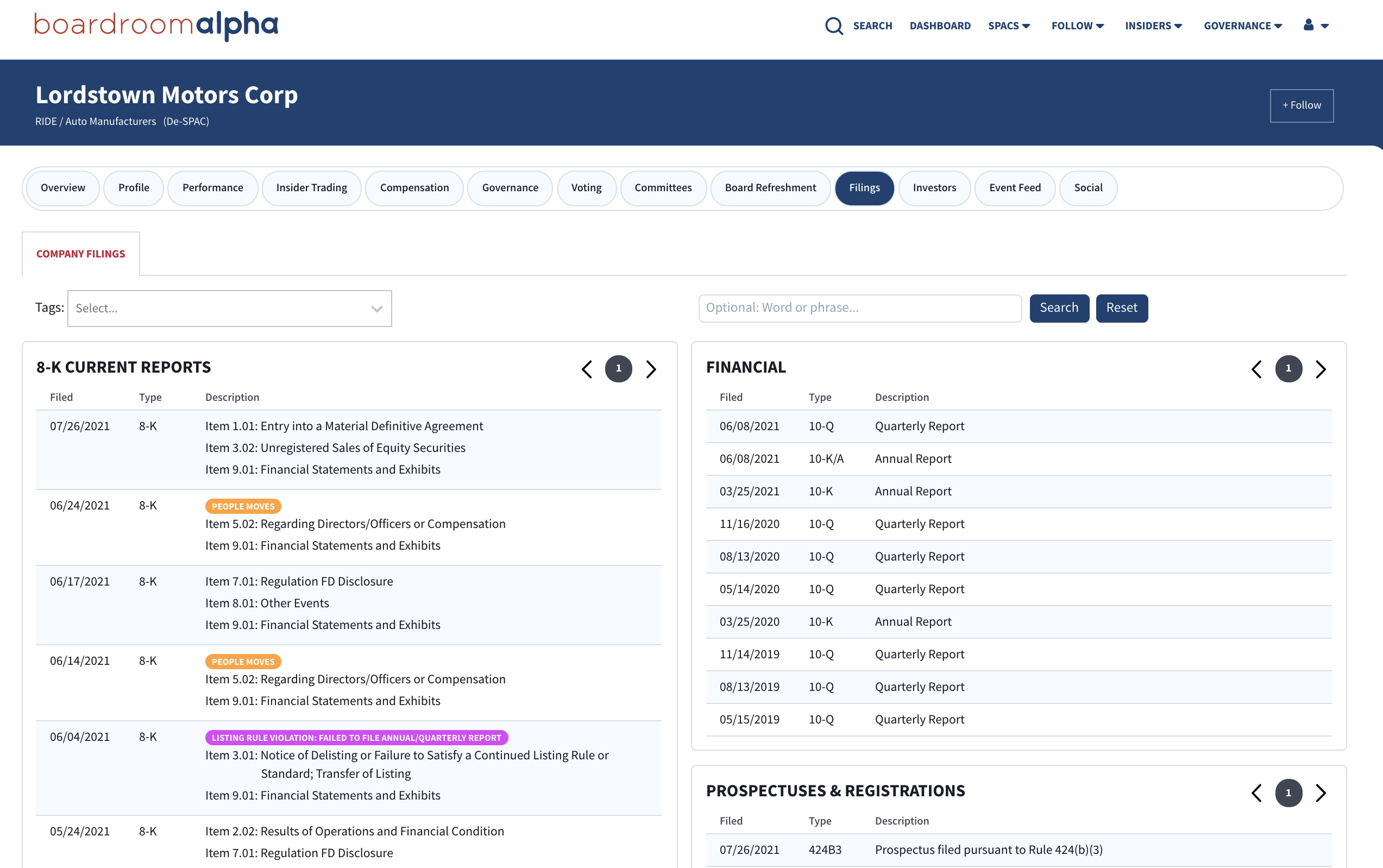

Intelligent SEC Filings Search & Tagging

Quickly search all SEC filings for a single company or across all companies. Leverage Boardroom Alpha’s machine learning classifications to quickly narrow your search to the most relevant filings.

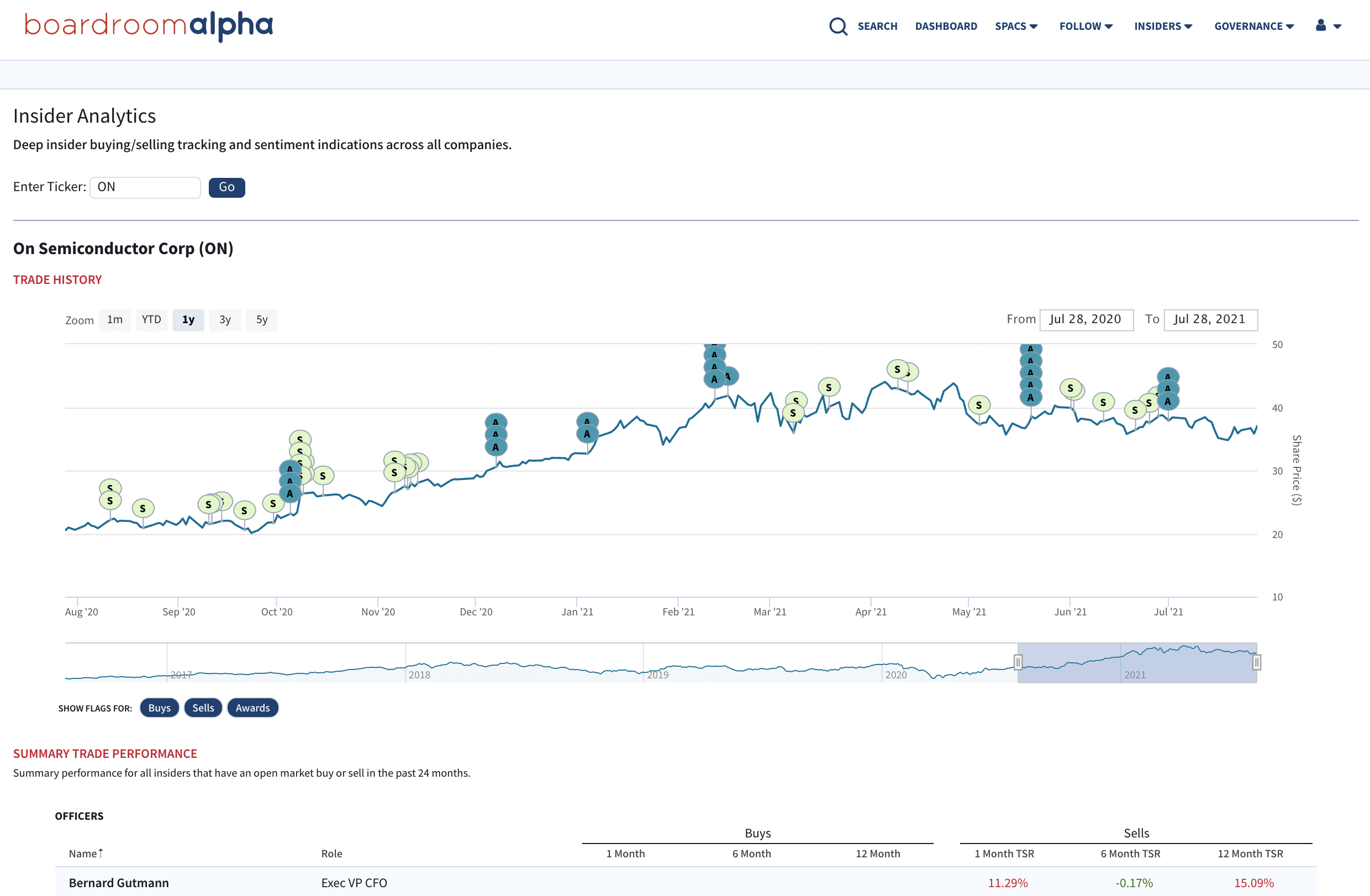

Monitor Insider Buying, Selling, and Awards

Monitor how a company’s CEO, executives, and directors are buying and selling their company’s stock. Also monitor awards relative to performance to watch for potential governance red flags.

Assess the activity on its own and relative to the company’s peers to see if their activity is out of the normal, accepted practices.

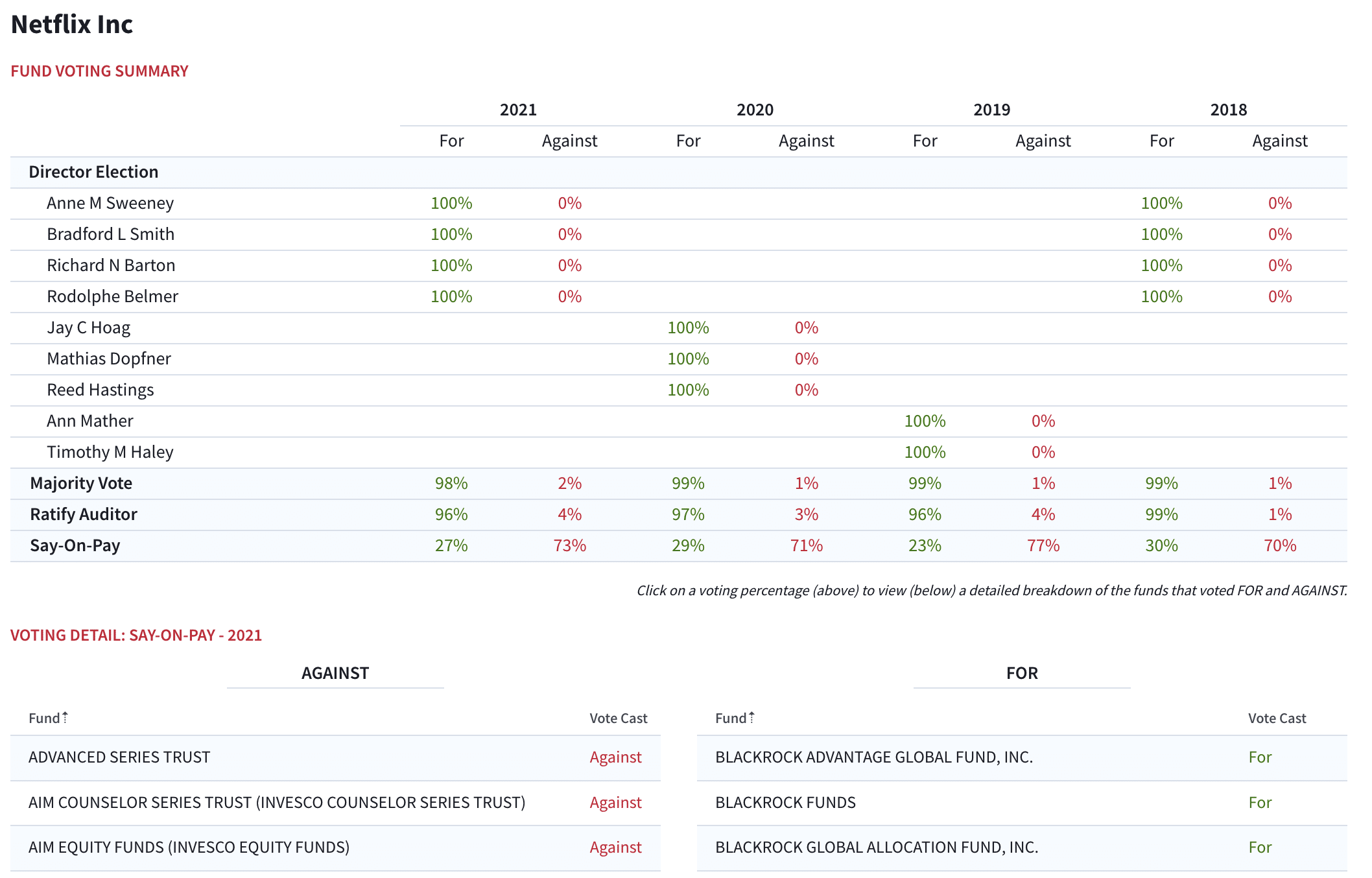

Identify Gaps in Institutional Shareholder Support

Get full visibility into how institutional shareholders are voting on key company and shareholder proposals. Discover which proposals lacked support and where potential shareholder risks are present.

Data & APIs

Boardroom Alpha's comprehensive governance and SPAC databases provide insight into the governance of all US publicly traded companies and the executives and directors behind them. Use our robust RESTful API, take data feeds, or integrate directly into Excel.

Governance

Data

- Executive Compensation data

- Director Compensation data

- Say-on-Pay voting

- Board Composition & Diversity

- Insider buying and selling (all Form 3, 4, 5) data

- Fund voting (from N-PX Filings)

- Board Independence

- Director Overboarding

Governance

Analytics

- Pay-for-performance

- Board interlock analytics

- Board performance analytics (TSR, ratings, and more)

- CEO performance analytics (TSR, ratings, and more)

- Diversity analytics

- Insider buying/selling analysis

SPAC Database

(Special Purpose Acquisition Companies)

Power your internal SPAC models and research systems with Boardroom Alpha’s comprehensive SPAC Database.

Includes all key data points including: IPO date, vote date, size, redemptions, team members, performance analytics, deal metrics and more.

Easily integrate using the RESTful database API.

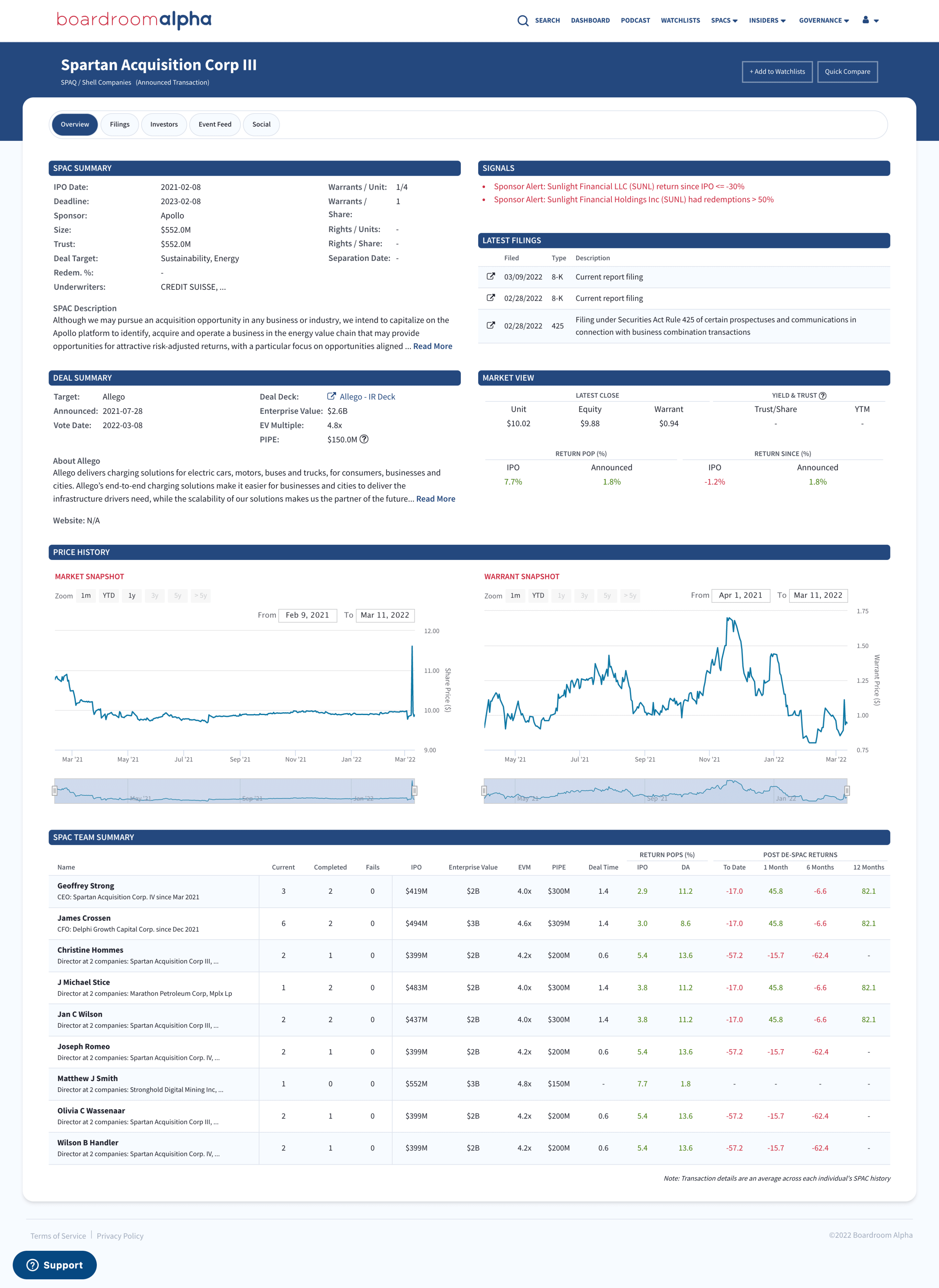

SPAC Research & Data Platform

Comprehensive SPAC database, actionable analytics, and powerful analyst interface to accelerate research and decisions.

Full details and analytics on every SPAC

Analytics and track record for every SPAC team member

SPAC sponsor tracking and analytics

Full SPAC tracking across lifecycle with specialized views for each

Real-time alerts and daily email briefs

Forward looking SPAC event calendar for shareholder meetings and more

Quick access to all filings and press releases